payPLUS adopts an integrated view of the online merchants and consumers

payPLUS empowers online merchants with a unified payments checkout enabling acceptance of all the popular online payment instruments such as cards, wallets, banking, EMI, BNPL, etc. across different online channels. payPLUS smart payment gateway manager is a feature-rich white-labeled payments orchestration platform that helps merchants seamlessly integrate with and manage multiple payment gateways/PSPs through a single interface – enabling optimization of overall cost & achieve better payment success rates.

WHO IS PAYPLUS FOR

A One-stop Shop for All Payment Acceptance Needs

payPLUS for Merchants

For online merchants integrating with multiple payment methods/payment service providers, payment optimization is a key necessity for better performance & revenue. payPLUS helps merchants with payments, while they focus on improving other business needs. Using payPLUS, merchants can better route the transactions , improve their payment success rates & cut down on costs through the smart routing module offering. The unified checkout offering helps tighten control over UI and enable a seamless checkout process. In addition, payPLUS also simplifies various payment management activities by offering value add modules like Payment links, Reconciliation Engine, Downtime alerts, and more

Key Features & Benefits

A Flexible and Customizable Offering

payPLUS is built over an extremely flexible and adaptive architecture that allows merchants to configure it to fit businesses of any nature, size, scale, and hierarchy.

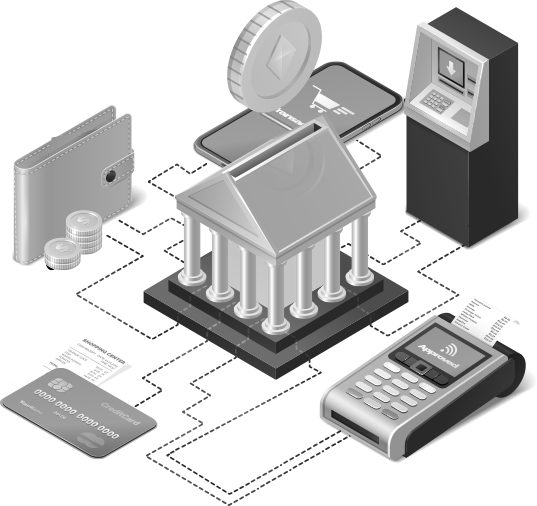

Complete One-Stop Payment Solution

payPLUS is a comprehensive, yet simple solution enabling online merchants to accept payments at all levels of a business through one system. payPLUS provides the right tools to simplify & optimize your payments stack

• Single Integration across PSPs & independent payment instruments

• Merchant Management module (up to N-level hierarchy)

• Unified Checkout forms for seamless presentation layer

• Unified dashboard & reporting

• Fraud management via partners & many more

Smart Routing

payPLUS offers a rules-based dynamic routing system. Depending on their requirements, merchants can easily set the rules to route transactions basis a wide range of conditions available including payment methods, business units, card schemes, issuers, currencies & more.

Invoice Payments

Securely generated web addresses that allow customers to make payments using all of the merchant’s supported payment methods ranging from cards to NB to Wallets & beyond. This also works for over-the-counter transactions where the customer is present and can also be scheduled by larger merchants for their recurrent customers

Reconciliation Engine

Reconciliation module with rules setting console enabling semi-automatic to automatic reconciliation at pre-defined frequencies between merchant transaction records and different PSPs settlement data. payPLUS also provides a unified dashboard and a wide range of reports for viewing the post-recon results and comparing settlement performance across PSPs

REASON TO CHOOSE

Feature-Rich

- Unified payment acceptance platform that supports all forms of payments ranging from cards to bank transfers to wallet to the UPIS on all types of customer channels ranging from an app to web to QR to payment links

- Rules-based Routing tools that provided higher success rates at a reduced MDR

- Admin-friendly features like invoice link payments, Rules-based Recon, New Age merchant management system etc.

REASON TO CHOOSE

Integration

- Readily available payment pages for all payment instruments as web SDKs, APP (IOS & Android) SDKs, OTB Apps & Web portals with supported transactions APIs for all types of payment

- Flexibility to integrate with leading PSPs, other payment providers for wallets & net banking etc.

REASON TO CHOOSE

Faster Time-to-Market

Supports rapid addition of new features without disruption in business operations

RELATED RESOURCES

Browse through for more information

RECENT AWARDS

India Technology Award (Code Studio 2019)

Comviva won the India Technology Award (Code Studio 2019) in the Best Technology Provider for Financial Technology (FinTech) Services for our PayPLUS Unified Payment Acceptance Solution.

FROM THE BLOG

Tackling global health challenges with Digital Payments

While medical science has, without a doubt, made significant strides over the past decade, challenges such as Ebola and Cholera still persist. Unlike the past, however, the global community is better prepared to counter these challenges …