mobiquity® Banking Suite provides a comprehensive digital banking and payments solution to banks that encompasses all factors essential for building a successful digital journey.

Omni-channel Banking

Enables banks to provide omnichannel banking experience to consumers, including mobile banking, internet banking, and banking on Gen-II channels.

API-fication

Allows banks to build, distribute and manage the lifecycle of APIs, and optimizing these banking APIs to cater to channel-specific requirements

Ecosystem Enablement

Facilitates banks to leverage the power of API infrastructure to offer banking services and data from a comprehensive ecosystem involving multiple market player

Personalized Experiences

Enables banks to provide tailor-made experiences to individual consumer personas or segments in real time based on consumer profile, behaviour,, context, time and location.

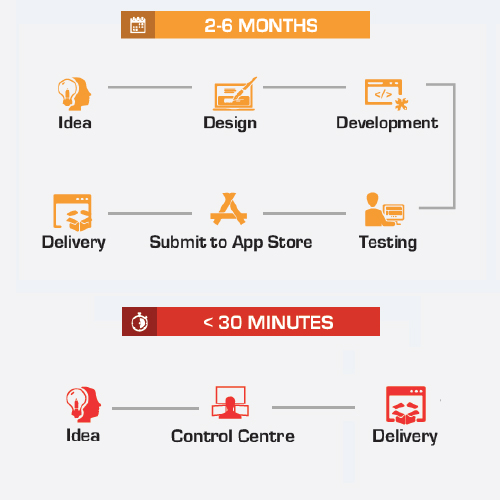

Rapid Service Launch

Provides extensive banking-aware business flows to quickly adapt to changes as well as offers a modular, flexible orchestration layer to enable faster service launches.

Frictionless Payments

Provides swift, secure, and frictionless remote and contactless proximity payments using prepaid wallets, HCE and QR Codes.

Experimentation

Facilitates scientific determination of user journeys to eliminate guesswork and optimize digital experience.

Key Features & Benefits

Enabling an Omni-Channel, Hyper-Personalised Retail Banking Experience

mobiquity® Banking Suite focuses on experience, engagement, and enablement, through functionalities such as experience automation, multi-channel availability, contactless payments etc. It is designed to enable banks to build successful digital strategies focused on consumers.

Experience Automation

- Personalization engine (segment & context-based UI/UX, Localization): Every consumer is unique! Personalize their experiences and cater to their specific needs

- Experimentation engine (A/B & multi-variate testing): Scientifically determine the experiences that work the best

- Instant Config: Decouple business decisions from code and deploy in real-time

- Dynamically control the app presentation layer (UI, UX, functional & data configs)

- Nurture customers with soft nudges to complete meaningful actions in the app

Building Great Apps

- App building capabilities: Native Android, iOS, Responsive Web, Bots, Wearables & Voice

- Auth Engine: Unified identity, authentication and authorization management across platforms

- Omni-channel sync: Provide seamless customer experience across devices/platforms

- Channel Optimizer: Create tailor-made and optimized API endpoints to fit your front-end apps’ needs without being constrained by the back-end systems

- Offline Handler: Provide seamless experience to your customers even when they are offline

‘Future Proofing’ the Banking Services

- One digital backend delivering optimized APIs for every front-end channel, while decoupling the dependencies on host APIs

- Provide Sandbox environment for API testing and verification

- Support & augment the legacy systems with secured storage, especially for offline use cases

Digitalization of All Services

- ‘Digitalization’ of all banking services, including digital onboarding – increases adoption & decreases the cost of serving consumers

- Launch new digital channels and provide a consistent experience across all channels

- Digitize all user journeys by interacting with multiple-host systems/micro-services

- Create custom user journeys facilitated by a digital backend with in-build orchestration capabilities

Open Banking Enablement

- Create partner ecosystems with control systems in place

- Transform the existing bank’s/host API to conform to the open banking API standards

- Be where your customers are. Deliver meaningful consumer experiences beyond conventional boundaries

- Offer ecosystem partners access to consumer data and banking services in exchange for additional revenue

Instrument Vault

- Instrument Vault is a smart digital container that mirrors a physical wallet and stores payment instruments to perform seamless financial transactions

- It allows consumers to add multiple payment instruments like Credit Cards, Debit Cards, and Bank Accounts to the digital payment service. These pre-added instruments can be used to load money into the prepaid wallet or make payments directly

- Consumers can also set a preferred instrument as delete and delete or block an instrument

Tap and Pay (using HCE and Tokenisation)

- mobiquity® Banking Suite provides swift and secure ‘Tap & Pay’ contactless payment experience to the customers at NFC POS machines, by leveraging HCE and Tokenisation.

- HCE enables the customer to have a digital version of the credit or debit card in their mobile phone and use it at payWave/payPass certified POS machines.

- Tokenization ensures that payments are executed in a secure manner, as unique tokens masks sensitive card details, while the transaction is being processed.

- mobiquity® is a multi-TSP (Token Service Provider) solution, readily integrated and certified for usage with Visa and Mastercard’s VTS and MDES TSP solutions, and provides support for any other TSP, using a single proprietary SDK, across devices. It supports other schemes like American Express and RuPay, to increase acceptability across more issuers and regions.

- Banks and card issuers have the flexibility to either use existing mobile banking applications or create a new application to launch ‘Tap & Pay’ contactless payment

Prepaid Wallet

- Equip consumers with a prepaid digital wallet, a virtual stored value account allowing them to:

- Transfer money using mobile numbers, email id or social handles

- Pay online merchants and billers remotely anytime anywhere

- Pay physical merchants by scanning static or dynamic QR Codes

- Recharge mobile and internet connections on the go

- Split bill with friends

- Leverage multi-tiered KYC model to facilitate quick onboarding of consumers

- Offer flexibility to add money to prepaid wallets through cards, bank accounts and agents

- Use a flexible Pricing Engine to quickly change and deliver competitive service charges to attract consumers

Token Vault

- “mobiquity® Banking Suite” empowers issuer banks with its “Token Vault” to tokenize their issued cards on online payment platforms. By acting as a token service provider (TSP) for On-Us transactions, Token Vault enables tokens to be used across the payment flow instead of actual card details.

- With Card-on File-Tokenization (CoFT) support, Banks can process transactions by directly connecting with their own authorization systems. This helps banks to minimize third-party fees & charges and reduce the overall cost of processing card payments.

- Token Vault facilitates secure card payments through tokens with advanced state-of-the-art

encryption techniques and provides end-to-end encryption between the bank and the

payment platforms. - Storage of cards in the form of unique tokens enables banks' customers to enjoy the same degree of convenience as using saved cards. Support for saved cards enables recurring

payments and faster checkout journeys for banks’ customers. - Complete Token life cycle management- With Token Vault, banks can

- Tokenize Card

- Detokenize Card

- Update Token State

- View Token details

- Continuous Logging at each step ensures auditing of the payments process

- Highly scalable to meet ever-growing consumer base & throughput requirements.

Building Payments Ecosystem

- Facilitate agency banking by equipping agents with virtual stored value accounts and building an expansive multi-hierarchy agent network

- Provide agents with float (e-money) to perform last-mile, over-the-counter transactions such as deposits, withdrawals, money transfers, and bill payments

- Provide a virtual stores value account to billers and merchants facilitating payment collection

- Enable merchants to pay suppliers, digitizing the complete supply chain

- Facilitate quick and easy agent and merchant onboarding

REASON TO CHOOSE

Deliver an omnichannel experience, and hands-off across multiple channels including new-generation channels like wearable, voice, and bots

REASON TO CHOOSE

Realize the true potential of their API infrastructure to build an extensible and flexible banking platform that provides new offering, meet consumer needs, build the ecosystem and increase revenues

REASON TO CHOOSE

Decouple UI/UX from code – enable business users to manage digital experiences in real-time, without relying on engineering teams

REASON TO CHOOSE

Faster time-to-market through inbuilt APIs, orchestration capabilities, and connectors

REASON TO CHOOSE

Enhance engagement with consumers effectively using personalization and experimentation engine

REASON TO CHOOSE

Micro-services-driven cloud native architecture

REASON TO CHOOSE

Provides swift, secure, and frictionless remote and contactless proximity payments using prepaid wallets, HCE and QR Codes.

REASON TO CHOOSE

Comviva is a qualified VISA Token Service Provider (TSP) vendor and is also listed on the Mastercard Engage Directory for Digital Wallets

REASON TO CHOOSE

Recognized by Gartner’s Market Guide for Digital Banking Multichannel Solutions, 2020, and Juniper Research’s Digital Banking trends report, 2020

REASON TO CHOOSE

Deployed by 21 banks and financial institutions in over 15 countries

RELATED RESOURCES

Browse through for more information

WEBINAR

To Win In Digital, Banks Need To Explore And Learn Faster

By Peter Wannemacher, Principal Analyst At Forrester & Deepak Mylapalli, GM, Product Management, Mobile Financial Services, Comviva

ANALYST MENTION

mobiquity® Banking featured in Gartner’s Market Guide on Multichannel Solutions

Second time in a row, Comviva mobiquity® Banking has been featured in Gartner Market Guide on Multichannel Solutions.

FROM THE BLOG

The Digital Future of Banking

The banking industry is undergoing a sea change. The gradual shift towards digital and especially mobile technologies, alongside changing customer demographics- particularly the heightened importance of millennials- offers significant opportunities for innovators.

RECENT AWARDS

India Technology Award (Code Studio 2019)

Comviva won the India Technology Award (Code Studio 2019) in the Best Technology Provider for Financial Technology (FinTech) Services for our PayPLUS Unified Payment Acceptance Solution.

LEADERSHIP TALK

Why Banks Require A “Digital” Strategy And Focus On Improving The Customer’s Experience

– Vivek Agrawal – Head, Enterprise Business, Comviva