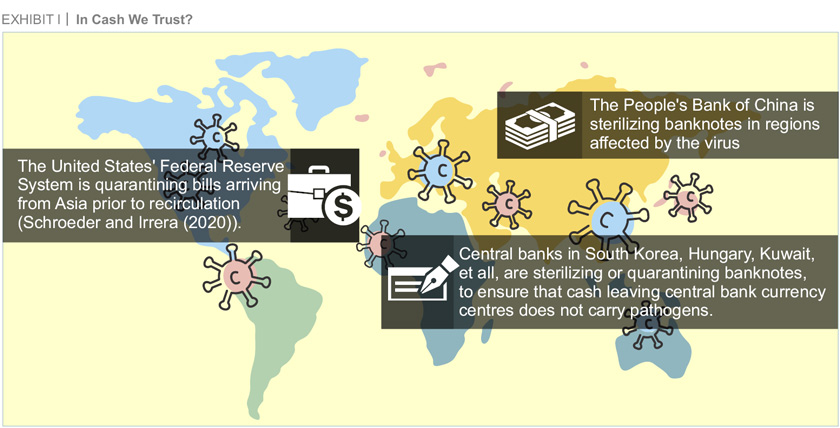

Apart from the real global threat to health and humanity, the 2019 novel coronavirus (2019- nCoV) has also brought forth multiple new challenges across various industries, including banking. Cash has, for instance, come under scrutiny, owing to the public concern pertaining to transmission of the virus via this instrument. To address this, banks around the world are undertaking various initiatives to reinstate universal acceptance. The South African Reserve Bank, for instance, has counteracted scams in a timely manner. It has clarified that there is no evidence of transmission by cash and it is not withdrawing this instrument from circulation (SARB 2020). Other measures taken globally include:

However, changed perceptions to cash are still significantly widespread. Globally, in fact, the emphasis is on creating a cashless economy.

Digital Payments: The Global War Cry

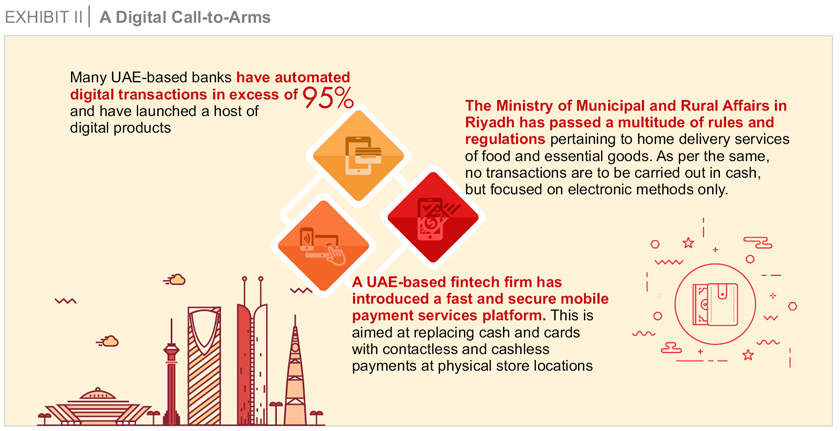

In this situation, digital payments have, therefore, emerged as a viable solution. Naturally, governments, global bodies, banks and financial service providers are focusing on pushing digital, contactless payments and remote banking.

Pushing Remote Banking and Digital Payments

In the Middle East, it is believed that the pandemic is more than likely to provide a tipping point to a cashless society and further digital connectivity. The emphasis on cash and cash -on-delivery will, therefore, cease to exist. Also, the demand for contactless mobile payments, such as Apple Pay, Google Pay, Samsung Pay and a bank's own payment application is expected to expand. In fact, contactless payments are already being focused upon. Various card schemes have increased the contactless payment limits across the region. In the banking space, leading players have encouraged customers to leverage digital and online banking services. Notably, over the past few years, banks in the region have already undertaken multiple digital payment financial service providers are focusing on pushing digital, contactless payments and remote banking. initiatives. This ranges from launching separate digital-only banking platforms, to strengthening existing mobile and online banking services with various technologies like QR code, NFC-HCE.

In the Middle East, it is believed that the pandemic is more than likely to provide a tipping point to a cashless society and further digital connectivity

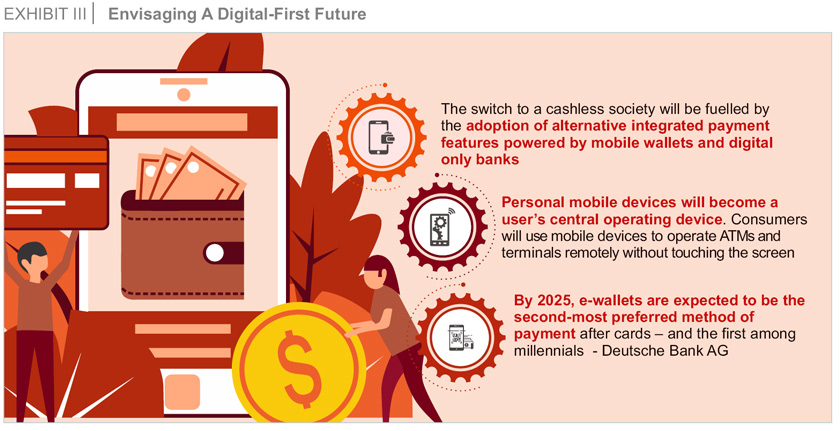

Envisaging a Post-2019-nCoV World

Of course, while it is too soon to envisage a post -2019-nCoV economy, new types of payment structures are well underway. However, while digital payments are certainly advancing by leaps and bounds, it remains to be seen if cash can be dismissed. Digital payments, such as contactless card payments have their own challenges. Their vulnerability to fraud is increased as they do not require a PIN for small transactions. Also, the divide between those with access to digital payments and those who don't is set to widen. This is, however, contingent on cash ceasing to be an acceptable payment instrument. Multiple technologies, too, are expected to come to the fore. All in all, the pandemic has certainly changed the face of the payments industry, as we know it. This is, however, only the beginning. One thing's certain, though-the best is yet to come, challenges notwithstanding.

Governments, global bodies, banks and financial service providers are focusing on pushing digital, contactless payments and remote banking.