“Through Bankily, BPM aims to extend financial inclusion and banking penetration in Mauritania. The product aims to make the opening of a bank account accessible to all Mauritanian citizens regardless of their geographic location and purchasing power. This mobile banking service fully supports the measures undertaken by the Central Bank of Mauritania to modernise and digitise the means of payments in the country. We are happy to partner with Comviva for offering Bankily services and meet the financial aspirations of our customers.”

Mohamed M’Rabih Rabou

Chief, Digital Banking Services, Banque Populaire de Mauritanie

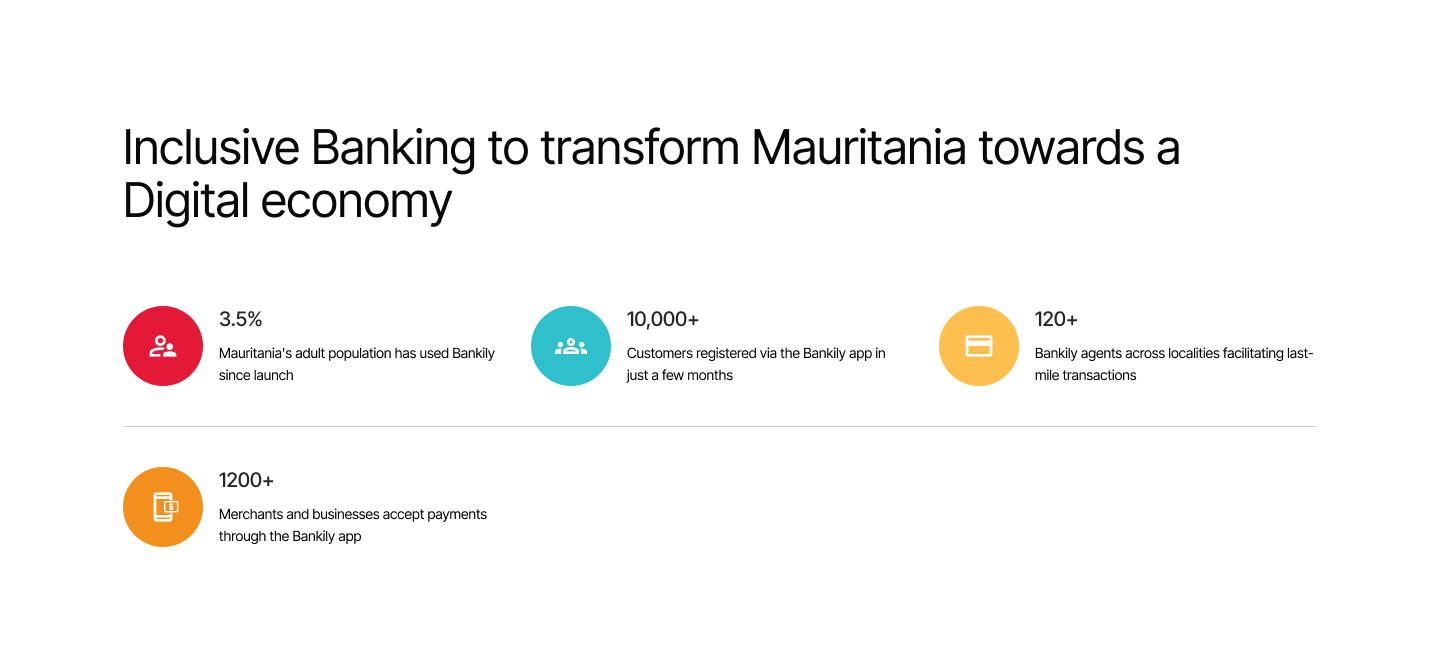

100,000+ customers onboarded in just a few months

Call for Change

Mauritania is a country with low banking penetration and income levels. Only 30% of the country’s adult population has banking access. Opening and managing bank accounts is costly and involves complex processes, documentation.

To overcome price, access, infrastructure and cultural barriers, BPM, a leading bank in Mauritania desired to launch a mobile banking service to provide digital remote bank account opening services and enable widespread access to money transfer and payments or digital payments – for both the banked and unbanked segments in the country.

Technology at Play

BPM partnered with Comviva to launch Mauritania’s first mobile bank, Bankily in Jan 2020, which allows users to provide digital remote bank account opening services and enable widespread access to money transfer and payments – for both the banked and unbanked segments in the country

Bankily is accessible through all mobile phones – smartphones or feature phones using mobile app or USSD *888# and enables multiple financial transactions digitally using next-generation digital technologies such as NFC, QR Code, and Facebook integration

Download Case Study : Click Here