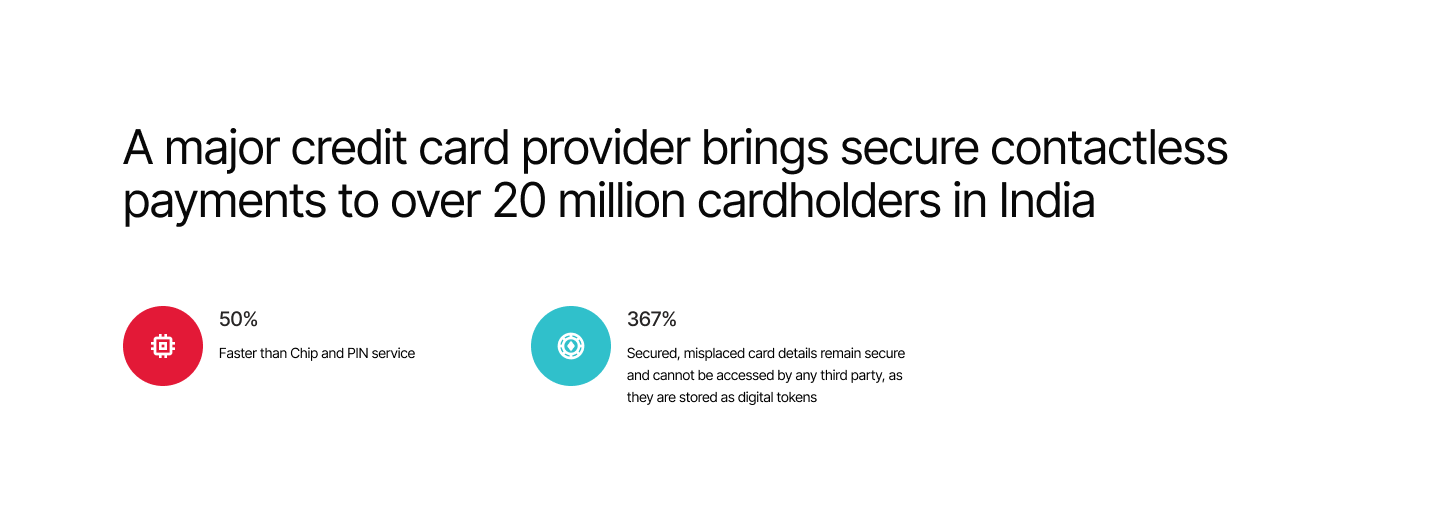

50% Faster than Chip and PIN service

Call for Change

Changing digital lifestyles of Indian consumers combined with the growth of contactless POS infrastructure in the country has created a huge demand for faster mobile-based transactions.

To quickly grab the advantage the leading credit card provider in India wanted to deliver seamless, secure, and convenient contactless mobile payments, bypassing a time-consuming and expensive process to upgrade millions of credit cards.

Technology at Play

Comviva provided HCE and Tokenization technology powered by the mobiquity® Banking Suite, to enable ‘Tap & Pay’ contactless payment experience to the client’s customers at NFC enabled POS machines.

The solution offered customers the freedom to onboard customers to the mobile tap and pay service, set daily transaction limits, manage card functions, and access support services all within one unified app.

Download Case Study : Click Here