Across the world, Retailers, Telcos and BFSI players have become increasingly hard-pressed to deliver value. The demand for differentiated and superlative customer experiences is constantly rising, but at the same time, service channels are moving away from CSP control. The Telecom and BFSI sectors are caught between regulatory pressure and customer expectations to enable uniform and personalized experience to customers and maintaining the profit margin at the same time. It is imperative that these processes move towards AI driven optimization

The predatory world weve described for these verticals requires some serious thought process to give businesses even the slightest edge at the point of sale (POS). And in a marketplace that expects personalization at the individual level, knowing thy customer is more important than even knowing thy self. This is precisely where data comes into play targeted best fit upsells. The data customers generate while they shop for products, while they look for alternatives, what they talk about on social media, and of course their behaviour once they enter or exit a physical or digital store. This data is key to a lot of insight into the customer, and analytics, also known as business intelligence, earlier, followed by big data analytics, played a key role in crystallizing the value proposition spelled out by data.

Today, the POS generates tremendous amounts of data, and with Analytics and AI coming to the forefront of the economy, POS systems need to be reimagined as well. To implement diverse customer journeys, across varied brands, with a multitude of products, you need the flexibility of the cloud while supporting numerous permutations and combinations of brick-and-mortar stores online and mobile checkouts, you need the agility and responsiveness that microservices can offer to handle shop level catalogue. For assisted and unassisted customer journeys that allow businesses, enablers, and aggregators to influence the sale, customer data is crucial for the business to map out the preferred journey towards purchase completion. The implication of a cloud-based POS product can translate into improved brand perception by aggregating information, opinions, and data relevant to the customer and the purchase, and providing them to the buyers based in a manner that promotes the brand as one that cares.

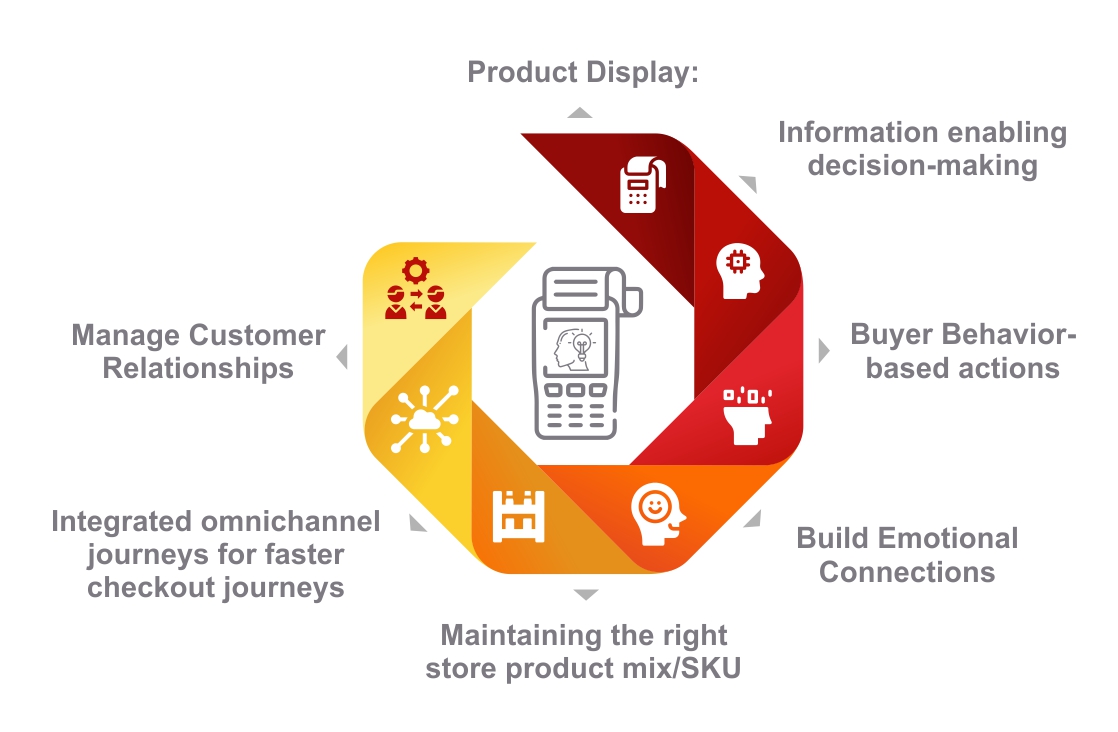

For example, customer data can give you insights into why a subscriber may be looking for a cellular plan. Competitor information aggregated could give clues into the customer challenges. Social listening can help narrow down the customer challenges, and intelligent positioning can close the sale. What you need is AI at the core, Cloud that pervades the different geographies and markets you operate in, and a simple, easy-to-integrate product that allows you to:

Recently, AI has been increasingly used to predict behaviour, patterns, and preferences based on historical and relevant data and moving multiple processes and KPIs towards AI based decision making is where the CSPs will move depending upon the ease of Adoption and accuracy of AI models to simulate and suggest real market scenarios, some of those KPIs and processes are listed below:

- Product Display: Information based on customer data can allow sellers to show the right products, right bundled products, and services to promote faster decision-making at the point of sale.

- Information enabling decision-making: Again, based on search, and social media insights, the right information shown to the customer can make decision-making faster, and build trust as a reliable information source.

- Buyer Behavior-based actions: Understanding prospects behavioral patterns can speed up time-to-completion, allowing faster and easier purchase completion. With historical data and relevant social data, sellers can find what motivates the buyer, whether it is a discount, reviews, after-sales service, or any other factor influencing the purchase.

- Build Emotional Connections: Customer data can help understand emotional motivations. From buyer groups to loyalty programs, the customers emotional connection with the brand can help drive future sales.

- Maintaining the right store product mix/SKU Understanding the right products that a store can maintain and sale relatively faster goes a long way in creating partner loyalty and increasing the profits for partner and CSP.

- Integrated omnichannel journeys for faster checkout journeys Customers are moving to multiple channels before finalizing a purchase and CSP needs to capture the context at these channels and use that to carry forward the order flow from other channels so that faster decision and checkout is done at the time of purchase. A Standards based and persistent shopping cart is one of the best ways to do it.

- Manage Customer Relationships Intelligent POS systems can use historical and other relevant data to identify secondary purchases, add-ons, and after-sales service options that the customer is likely to be excited by. It results in increased customer loyalty as the brand is seen to be catering to their current and future needs.

Click here to read the first part.