Mobile virtual network operator

Mobile virtual network operator (MVNO) is a wireless communications services provider which does not own the network infrastructure that is used to serve its customers. An MVNO secures bulk access to network services at wholesale rates from mobile network operator to and sets retail prices independently. An MVNO may use its own customer service, billing systems, marketing, and sales personnel, or it can outsource to a mobile virtual network enabler (MVNE).

History of MVNOs

The Nordic countries and Denmark in particular was among the early adopters of telecommunications markets liberalization across Europe leading to introduction of full competition in July 1996 in Denmark.

Two years later, in 1998 Sense Communication (Net system International) a Norwegian company, was ready to challenge the duoply (Telenor and Netcom) in Norway by taking the first steps towards Mobile Virtual Network Operator (MVNO). Sense planned to enter in interconnection agreements, with the MNOs Denmark (Sonofon), Sweden (Telia), Norway (Telenor) and Finland (Sonera). Senses proposal included the use of its own SIM cards and Mobile Network Code (MNC). This proposal lead to mobile operators refusing to give Sense access to networks as acceptance of another operators SIM card was considered roaming. Sense retaliated by appealing to respective National Telecommunications Authorities (NRA).

In September 1998, the Norwegian NRA ruled in favour of Sense with the view that Sense is aimed at establishing a virtual pan-European network that makes it possible to route traffic in their own networks across borders thus establishing an alternate to the existing roaming agreements.

The MNOs in Norway appealed against the NRA ruling, and the Ministry of Communications decided to review the matter and presented a report to the Norwegian Parliament in Autumn of 1998.

NRA of Denmark and Sweden decided that the network operators were not required to accommodate Senses request for access since the connection request from Sense was roaming and not interconnection.

The National Telecommunications Authorities believed that MVNOs would lead to competitiveness of the mobile market and as a result, proposed amendments which would oblige networks to provide access to MVNOs.

Support from the National Telecommunications Authorities was too late as Sense succumbed due to the lack of agreements with the operators and in April 1999 managed to return from bankruptcy with another MVNO operational model aligned more with mobile network operators.

UK first to launch MVNO

The Office of Communications (Ofcom, earlier known as Oftel) in United Kingdom became aware of the concept of Mobile Virtual Network Operators (MVNOs) and Senses negotiations in Scandinavia.

In June 1999, Ofcom began reviewing the potential of introducing MVNOs in UK market.

This was followed-up with launch of the first MVNO Virgin Mobile UK on 11-11-1999. It was a 50:50 private joint-venture between Virgin Group, and Deutsche Telekoms One2One.

Launch of first five MVNOs

| MVNO | Country | Host | Date |

| Virgin Mobile UK | United Kingdom | One2one | 11th November, 1999 |

| Sense | Norway | Telenor | 17th January, 2000 |

| Club Blah Blah | Denmark | Sonofon | 1st October, 2000 |

| Tele2 A/S | Denmark | Sonofon | 9th October, 2000 |

| Telmore | Denmark | TDC | 30th October, 2000 |

Surprisingly, The Danish mobile network operator Sonofon, who initially refused access to Sense Communications in 1998, entered into two MVNO agreements and out of the first five MVNOs, Denmark was home to three of them.

Aftermath of MVNO launch

Number of mobile subscriptions in Denmark grew by 7% to a total of 4.785 million (88.9% penetration) by end of 2003. It is worth mentioning that collective customer base of the five Mobile Network Operators: TDC, Sonofon, Orange, Telia and Hi3G, fell by 2.4% to 3.69 million, whereas the subscriber base across three Danish MVNOs saw a combined rise by of 74% from 558,000 to 973,000. Leader among the three MVNOs was Telmore which managed to attract a 9% (453.815) market share.

As the above data suggests, Danish MNOs had been forced into competition, leading to average cost of voice call rates slashing by almost 50% in the last six months of 2003. This also resulted in Danish incumbent TDC, acquiring Telmore (20% in April 2003 and remainder in December 2003).

Telmore grew rapidly from just 130,000 customers in mid-2002, to 460,000 customers in Dec 2003 when TDC took over. TDC still continues with the brand Telmore is testimony to the fact that the success and user satisfaction of Telmore was very strong.

Telecommunication markets across the globe have been transformed by the introduction of MVNOs. Following are the key benefits driving the transformation:-

- Service innovation

- Greater options for consumers

- Price reduction

- Increased market penetration.

Key Models of MVNOs

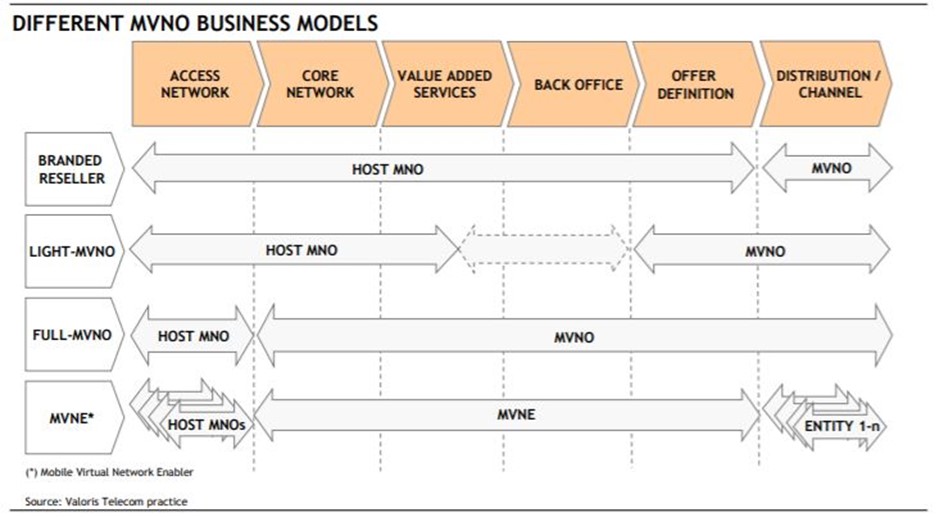

Model selection of an MVNO is based on risk and potential linked with the model and target objective of the MVNO.

Below diagram explains the business models available for the MVNOs:-

How PreTUPS Voucher Management System can help MNOs and MVNOs

Comvivas PreTUPS Voucher Management System (VMS) is the most comprehensive voucher management system and provides multi network support to on-board MVNOs thus helping the MNOs. PreTUPS VMS covers wide range of physical, electronic and digital voucher types. Further, PreTUPS VMS enables MNOs and MVNOs to manage and track end to end life cycle of vouchers starting from voucher generation, distribution and redemption. Expiry date of voucher can also be extended beyond the defined expiry date to avoid losses due to expiry. PreTUPS has recently helped a leading mobile operator in sub Saharan Africa to launch an MVNO with efficient time to market.

Conclusion

Across globe there are approximately 1600 MVNO operational and this number is expected to reach 2000 by year 2025. Currently, the global MVNO market valued at US$62.5 bn and forecast is to cross US$100 bn mark by 2025.

MVNOs need to have a clear vision and value proposition to be successful in ever growing competition. In many markets, MVNOs are face increased competition as mobile operators themselves launch sub-brands to directly compete with MVNOs. Going forward, MVNOs can focus on new technologies including Big Data, AI, IoT and, Connected Cars to name a few. They can also expand connectivity to emerging markets majorly Sub-Saharan Africa to connect the unconnected.