“In Colombia, people need to have a bank account or credit card to make digital payments online, leaving majority of Colombians out of the digital payment revolution. We are trying to change this picture with MOVii which provided access to digital financial services to all Colombians without any bias. With MOVii any Colombian, banked or unbanked, can make all kind of payments securely, easily and without any cost from their mobile phone. Our goal is to bring digital financial service to the masses and Comviva mobiquity® is the right technology platform partner to achieve that aim.”

Hernando Rubio

Co-founder, CEO, MOVii

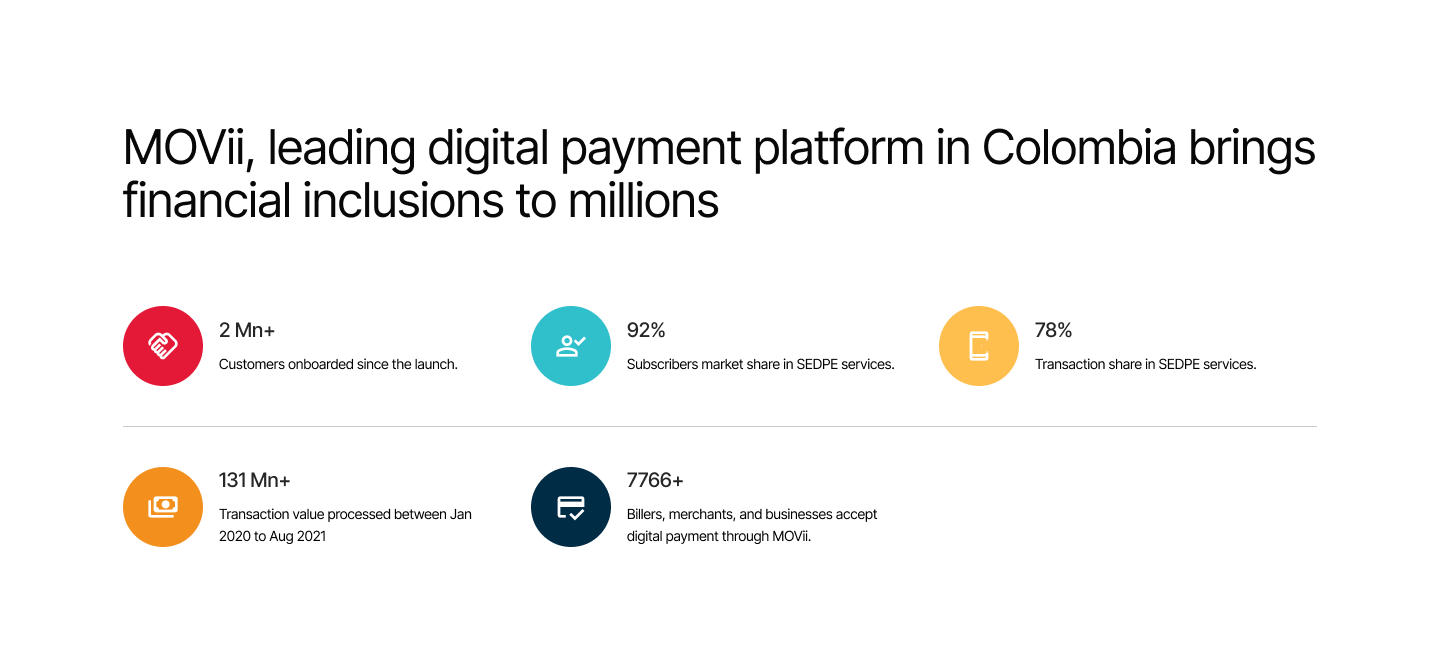

2 Mn+ customers onboarded since the launch

Call for Change

Colombia is Latin America’s third most-populous country and one with high smartphone-penetration and high internet-usage, still banking in Colombia is conventional with just 46% Colombian adults having a bank-account

With a vision to democratize access to financial services in Colombia and create a path towards a digital economy, MOVii, the largest SEDPE in Colombia was established

Technology at Play

Comviva worked with MOVii to deploy mobiquity® Pay to power the MOVii wallet app, which provides customers a virtual stored value account (mobile wallet) linked to their mobile number. The market leading mobiquity® platform enables MOVii to deliver a host of innovative mobile money services that transforms the way consumers save, borrow, transfer, and spend money in Colombia

Today, Movii is the largest SEDPE in Colombia, extending low-cost financial access to the unbanked and underserved segments of the country

Download Case Study : Click Here