The Premise

Digital Commerce & Payments: Evolution & Current Landscape

As digital commerce rapidly evolves, competition intensifies – making every user touchpoint a critical opportunity to differentiate your brand.

This is specially applicable for payments as the payment experience can turn into the biggest builder of trust leading to increased lifetime value. Failing at this can hamper the entire experience leading to customers switching away to competitors.

Designing a Seamless Payment Experience

Customers need to be guaranteed a 100% success rate for their payments. Fail-proofing payments, making them fast and secure are non-negotiables for businesses that run commercial transactions digitally.

Payment failures can directly lead to revenue leakage as 1 out of 3 customers will not return after a bad experience. It can also increase costs associated with reconciliation. Hence, it becomes all the more important for businesses to ensure an effective payment orchestration set up.

Key Operational Challenges In Payment Orchestration

Traditional digital payment solutions were built for stability – not for the speed, personalization, and complexity of today’s digital commerce ecosystem. While traditional payment orchestration laid the foundation for multi-gateway routing, the next generation must deliver real-time intelligence, flexibility, and optimization across the entire payment journey.

Here are some reasons to reassess their value:

1. High Engineering Overheads:

Traditionally, digital merchants faced challenges integrating with multiple payment service providers (PSPs) – each taking anywhere between 1-4 weeks. A single integration puts too much at stake as payment success isn’t guaranteed at all times despite the heavy engineering effort behind it. Repeat this for the ‘n’ number of PSP integrations a business would need and it translates into both extended timelines and inflated costs.

2. Manual Reconciliation & Delays

Payment failures not just cause distress to customers but also trigger a sequence of whirlwinding steps for reconciliation. This involves multiple calls and email threads across merchants, PSPs and financial institutions thereby making it a delayed and a cumbersome process.

3. Complex Compliance Requirements

Payments are governed by many regulations and compliances such as KYC that keep changing from time to time. It requires manual intervention and audits to make sure these are adhered to.

4. Ever Changing Integrations

Every system is continuously evolving. For example, payment gateways frequently update their APIs and protocols to enhance security, introduce new features, or comply with regulations. As a result, businesses must rely on ongoing developer support to keep these integrations up to date. The broader the range of payment options, the greater the dependency on technical resources. This constant need to adapt to changing integrations and upgrades can quickly become cumbersome and resource-intensive.

What is a Payment Orchestration Layer and Why Now?

A payment orchestration layer is a control tower for digital payments that connects different processors, business platforms (CRMs and order management systems) and add-ons like fraud checks, analytics, wallets and loyalty programs – providing a unified infrastructure. This makes it easier for businesses to run smooth, streamlined, end-to-end payment operations. . Before delving further, let us take a look at some key operational challenges that businesses are facing today.

Here are 4 reasons for businesses to embrace payment orchestration platforms:

1. Minimizing payment failures

Payment failures can get in the way of creating a smooth purchase experience. It can increase cart abandonment and also dents trust. To reduce payment failures needs to be a top priority for businesses.

The orchestration layer helps secure the payment completion and reduces the chances of failure significantly.

2. Reducing MDRs

Depending on the total value of the purchase, the MDRs can affect the total value of the sale. An orchestration layer allows intelligent selection thereby helping reduce MDRs.

3. Freedom from Manual Integrations & Operations

The complexities of manual integrations with PSPs can be cumbersome and hard to manage. On one side, setting up these integrations for the first time can take up to weeks. On the other side, catching up with updates to APIs is a whole other challenge. All of this puts a lot of overhead and dependency on developers.

There are also scenarios where a gateway does not work and then the teams realise there has been a break in the integration due to an updated API. This puts them on the back foot and has a ripple effect on both customer experience and internal efficiencies.

4. Improving Compliance Adherence

A payment orchestration layer centralizes compliance management across multiple payment providers, ensuring consistent adherence to regulations. This reduces the risk of violations and simplifies audits by automating controls and providing unified reporting.

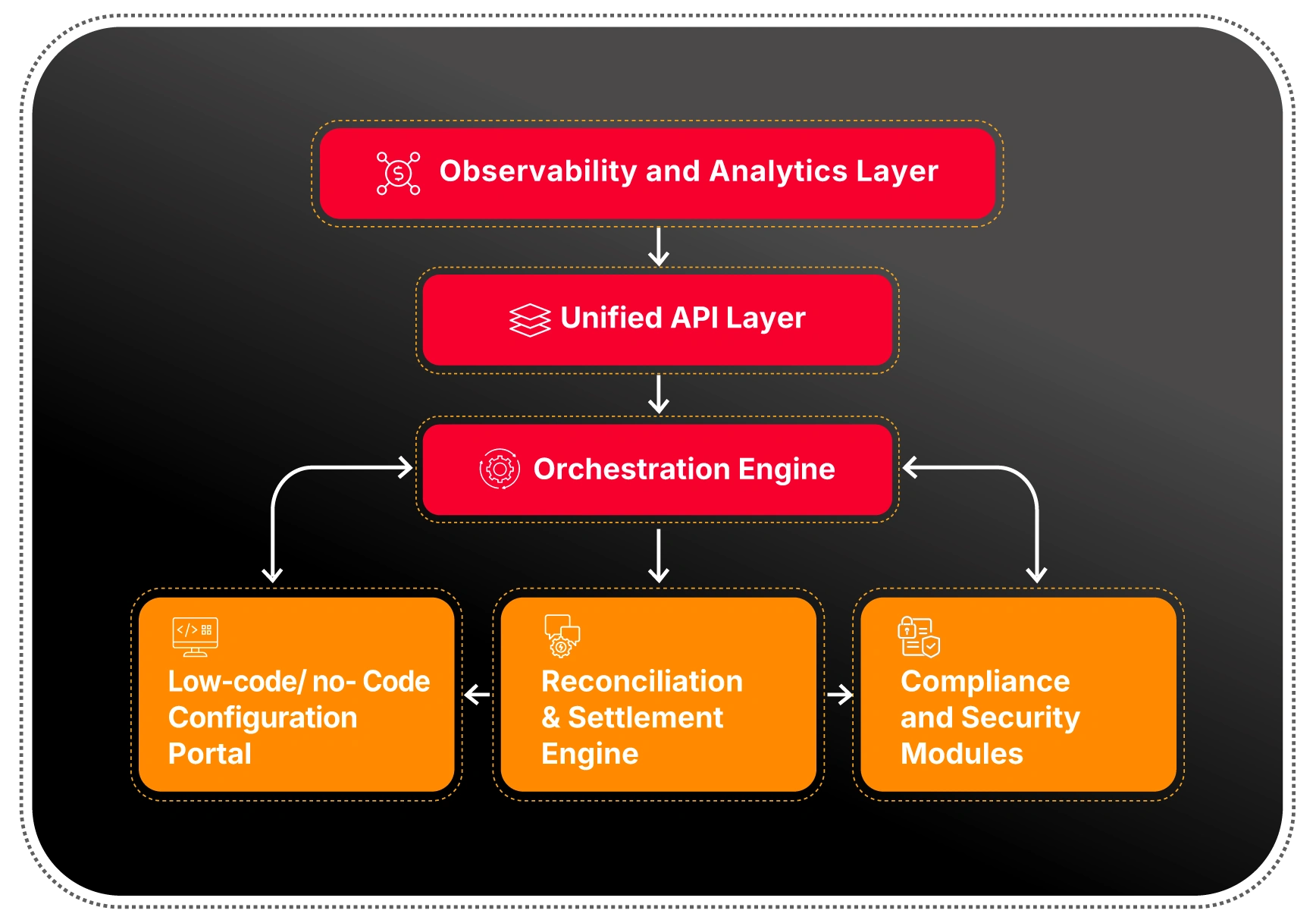

How mobiquity® One Helps Improve Efficiency & Minimizes Failures

Comviva’s mobiquity® One is a fast growing payment orchestration platform built to help businesses handle scale and complexities with ease. It is designed to prevent payment failures and help teams manage the payment experience seamlessly.

1. Single API: Many gateways & modes

Say goodbye to managing multiple API integrations and layers by unifying multiple systems under one single API. This opens up an array of payment service providers, gateways and financial services that are pre-integrated with the platform.

Impact: Shorten the runway to orchestrate payments seamlessly. From 6 weeks to merely hours, the effort that needs to go into manual integrations is drastically reduced.

2. Reduced payment failures with AI-powered smart routing

mobiquity® One’s AI-based routing ensures that transactions are processed through careful selection based on uptime, costs, processing fees, thereby of the most optimal PSP/gateways. In case of payment failures through the chosen gateway, the system automatically chooses the next best gateway immediately to ensure the user does not suffer.

Impact: Reduce payment failures to reduce support costs and long reconciliation procedures. Prevent revenue leakage and boost the payment experience for consumers to improve lifetime value.

3. Make service providers accountable with real-time performance dashboards

The platform presents a real-time dashboard view of different PSPs and gateways. This gives the retailer/marketplace owner a chance to hold them accountable for their uptime and negotiate better rates.

Impact: Negotiate better rates with service providers and set SLAs for uptime and availability. Have better control and visibility over their performance and instill accountability.

4. Prevent fraud with advanced security protocols

Fortify your payment infrastructure from fraud with advanced, enterprise-grade security protocols. Embed real-time risk assessment, anomaly detection, and compliance with global standards to safeguard every transaction. Leverage AI-driven monitoring with multi-layered authentication.

Impact: Increase customer trust while reducing exposure to fraud-related losses.

5. Customizable workflows

Configure payment processes that suit your business with customizable workflows. Keep your processes light and agile to incorporate changes from time to time, as required.

Impact: Keep your processes agile and easy to manage.

All of these add to revenue lift, better relationships with PSPs and improved customer lifetime value due to reduced cart abandonment and payment failures.

Impact on Product, Technology & Finance Teams

A payment orchestration solution like mobiquity® One can have a profound impact on different functions in an organization. Here are the ways it helps improve efficiency for different functions.

Product: It saves significant effort related to new payment options, provisioning for new modes and API integrations by simplifying it through a single API. The focus can be more towards building better customer experiences without worrying too much about payment failures.

Technology: Integrations are a boon to tech teams. It saves significant time by making go-lives faster with pre-built integrations and boosts productivity for teams. It also reduces troubleshooting effort for analyzing payment failures as the orchestration layer solves for the root cause – payment failures.

Finance: Significant reconciliation effort is saved for finance teams. Large number of payment failures can lead to high reconciliation requirements. By reducing payment failures and automating it at every stage, it not just reduces failure rates but also provides channel-level visibility and helps quickly identify the channel leading to the failure thereby paving the way for faster reconciliation. mobiquity® One consolidates reporting from different PSPs making it easier for the finance team to reconcile payments.

Client Success Story: Streamlining Payments for a Seamless Gift-Giving Experience

Ferns & Petals, India’s leading floral & gifting retailer, faced inefficiencies in its payment infrastructure due to fragmented gateway integrations that affected checkout reliability and user experience. To address this, FNP partnered with Comviva to implement the mobiquity® One orchestration platform, which unified multiple payment gateways under a single system, enabling real-time smart routing and significantly reducing transaction failures.

A rewarding partnership

By integrating mobiquity® One, FNP now offers customers faster, more secure, and frictionless checkout experiences with support for diverse payment methods like UPI, wallets, net banking, and cards. The AI-driven orchestration layer optimizes routing decisions based on performance and cost, boosting efficiency while lowering operational overhead.

This transformative partnership also earned FNP and Comviva the Gold award for “Best Digital Payment Facilitator” at the 2025 Drivers of Digital Awards, recognizing their achievement in elevating transaction success rates – particularly during high-volume gifting seasons such as Valentine’s Day, where mobiquity® One delivered a significant improvement in payment success rates.

Ready to transform your payment experience?

As we understand how a seamless payment experience is fundamental to businesses, leverage Comviva’s mobiquity® One with its powerful enterprise-ready capabilities to achieve the same. It offers telco-grade reliability, extensive pre-integrations, enterprise-grade scalability and API-first architecture to suit the needs of modern day businesses.

It has a solid footprint in growth markets across telecom, BFSI, OTT, retail/e-commerce and more and is helping businesses unlock new standards of operational excellence in payments.