A regional telecom provider had everything in place for a planned service rollout—inventory stocked, promotional campaigns launched, and field agents on standby. But by mid-day, complaints started pouring in. SIMs hadn’t reached the stores, installation devices were untraceable, and field staff were rerouting deliveries manually. The reason? A visibility breakdown between their distribution system and third-party logistics. With no real-time tracking, no consolidated partner management, and no control at the last mile, the entire launch slipped by 72 hours—impacting revenues, operations, and customer trust.

This scenario is not unique. For telecom operators navigating increasingly distributed networks, fragmented last-mile logistics and partner ecosystems are becoming a silent growth barrier. The absence of digitized distribution management isn’t just an operational flaw—it’s a strategic risk.

In today’s telecom landscape, last-mile distribution is more than just the final step in delivering a SIM or device—it’s the linchpin of operational efficiency and customer experience. As telecom operators expand to serve a growing user base, managing logistics—from warehouses to Points-of-Sale (PoS)—has become increasingly complex and costly. The good news? These challenges are solvable with the right mix of automation, partner management, and supply chain visibility.

Understanding Last-Mile Distribution in Telecom

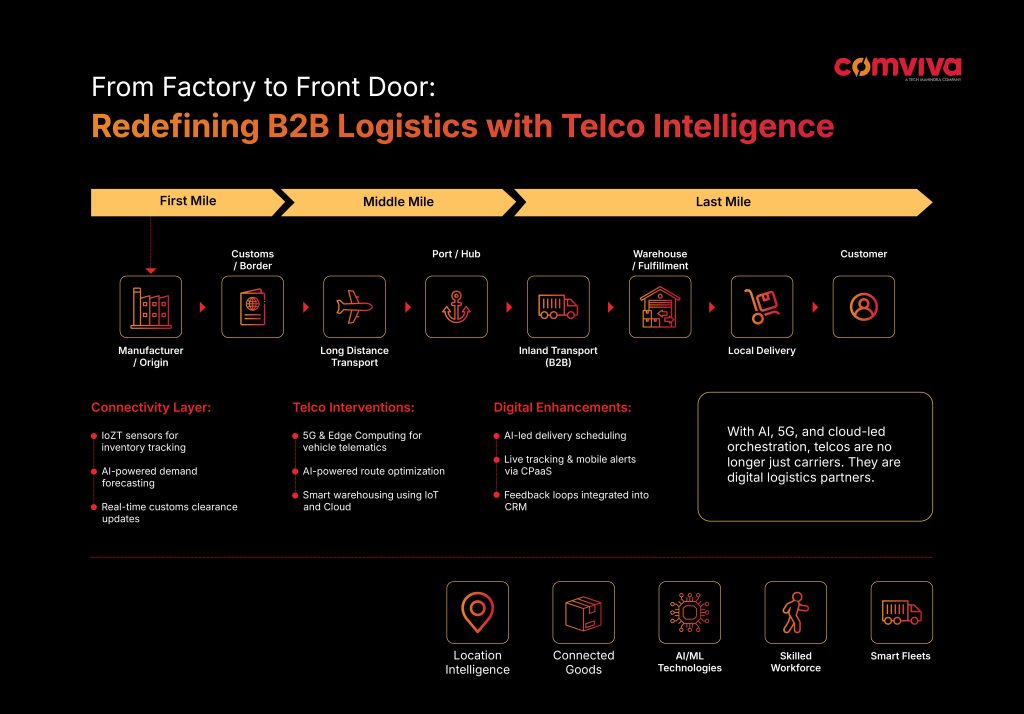

Last-mile logistics in telecom refers to the distribution of SIMs, eSIMs, vouchers, and network devices from centralized hubs to end-users via warehouses, field agents, and third-party partners. This phase is critical to enabling service activation and maintaining seamless customer experiences across urban and rural markets.

However, the journey from central inventory to the customer often involves multiple intermediaries—distributors, PoS agents, field force, and 3PLs—creating ample room for delays, mismanagement, and cost escalations.

In fact, 70% of global business leaders believe that poor visibility and manual operations in the last mile significantly increase operational costs .

Pain Points in Last-Mile Distribution for Telecom

- Lack of Real-Time Tracking & Visibility: Without a single pane of visibility across warehouses, shipments, PoS, and field operations, telcos struggle with delivery failures, loss of inventory, and poor customer communication. This not only raises costs but also leads to brand erosion when service activations are delayed.

- Overdependence on 3PLs: With high reliance on third-party logistics for last-mile delivery, telcos lose control over SLAs, face delayed rollouts, and increase risk exposure during high-demand periods such as launches or regional expansions.

- Fragmented Partner & Hierarchy Management: Telecom supply chains often involve multi-tiered hierarchies—distributors, sub-distributors, and retailers. Without centralized partner and hierarchy management, coordination breaks down, leading to delayed equipment delivery and inconsistent commission handling.

Impact of Last-Mile Challenges on Telecom Businesses

Delayed Network Expansions

Poor last-mile execution can delay rollout timelines—hurting first-mover advantage, slowing new revenue streams, and affecting rural connectivity drives.

Rising Operational Costs

Lack of automation, inefficient field operations, and unmanaged warehousing processes inflate last-mile costs. These expenses, compounded across multiple markets, can severely dent margins.

Compromised Customer Experience

Activation delays, missing devices, and service lags damage trust and increase churn. Customer complaints about installation delays and lack of order tracking transparency are on the rise, especially in hyper-competitive telecom environments.

Strategies to Overcome Last-Mile Distribution Challenges

Mobile App–Driven Field Force Management

Digitally empowering field service executives (FSEs) with beat plans, location tracking, and service logs ensures faster resolution, real-time coordination, and better SLA adherence.

Process Automation & Route Optimization

Using AI-driven route optimization helps reduce fuel costs, boost delivery accuracy, and manage fluctuating field volumes efficiently .

Integrated Partner & Distribution Hierarchy Management

Unified systems that map partners, sub-partners, and their PoS outlets help streamline commission structures, ensure transparency, and reduce delays.

Warehouse & Inventory Digitization

Digital inventory tracking and automated reconciliation enable operators to reduce dead stock, improve valuation accuracy, and plan replenishments better.

Cost & Compliance Management

Embedding compliance workflows into logistics platforms ensures timely regulatory reporting, prevents fraud, and reduces financial leakage.

Future Trends in Telecom Logistics & Last-Mile Distribution

The industry is poised for disruptive transformation:

- Autonomous Delivery: The use of drones and autonomous vehicles to deliver equipment in remote regions is being explored.

- Blockchain for Logistics: Secure, tamper-proof transaction trails to reduce fraud in partner commissions and inventory logs.

- API-Driven Integration: Telecom systems are moving toward seamless API-based logistics ecosystems for real-time decision-making.

Section 6: Conclusion & Key Takeaways

For telecom leaders, solving last-mile challenges is no longer optional—it’s a business imperative. Whether you’re a COO looking to reduce rollout timelines or a VP Sales aiming to speed up SIM delivery, the benefits of a streamlined telecom logistics system are undeniable:

- Lower logistics costs and fraud

- Improved partner transparency and compliance

- Faster customer activation and better NPS

- Greater agility in launching new markets and services

With solutions like Comviva’s Distribution Management Suite, operators can finally move from chaos to control—across hierarchy, warehousing, PoS, and partner ecosystems.