COVID-19 has accelerated the pace of digital transformation in multiple industries such banking. As per a study from Juniper Research, 53% of the worlds population will access digital banking services in 2026; reaching over 4.2 billion digital banking users, from 2.5 billion in 2021. Digital transformation happening in banking industry entails multiple aspects. On one hand it includes providing access of banking services to consumers through digital channels such as internet, mobile, wearable and enabling them to make financial transactions digitally anytime anywhere. On the other hand it involves digitalization of banking processes such as customer on-boarding and loan application, which was usually performed manually at the bank branches in the pre-COVID times.

Customer on-boarding is a key process, which an increasing number of banks are digitalizing by introducing Digital Know Your Customer (Digital KYC) processes such as eKYC or Video KYC. Digital KYC allows consumers to conveniently and seamlessly open a bank account or subscribe to a digital wallet or payment service remotely from their home through a digital channel like a mobile phone. Digital KYC has become important for banks to smoothly operate their business during COVID times as movement of people is restricted during lockdowns and many avoid visiting crowded bank branches due to fear of pandemic spread. Many previously unbanked people want to open bank account to receive COVID government grants or financial-aid during pandemic or simply do financial transactions digitally and remotely from home during restricted movement.

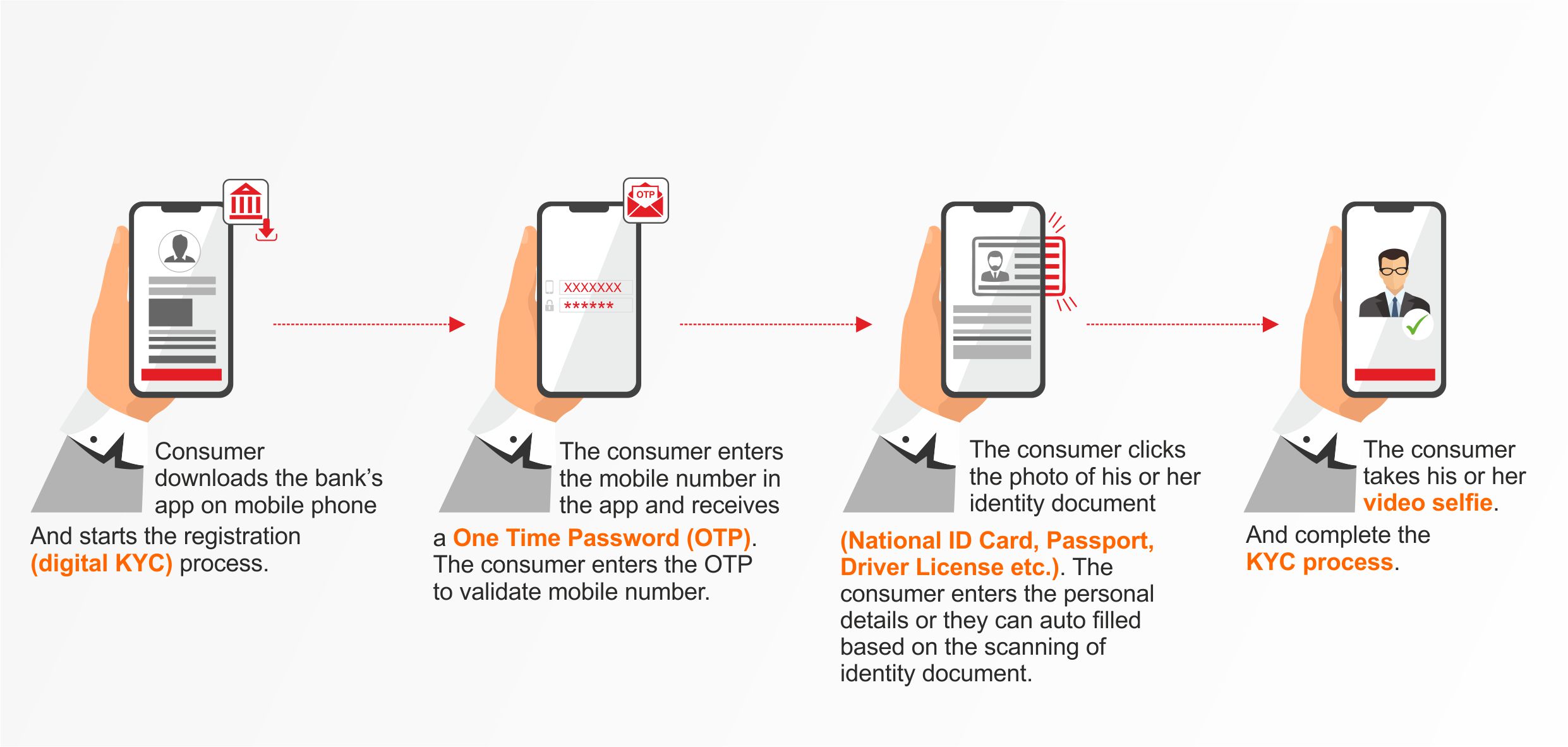

An example of digital KYC user journey can be as follow:

- Consumer downloads the banks app on mobile phone and starts the registration (digital KYC) process.

- The consumer enters the mobile number in the app and receives a One Time Password (OTP). The consumer enters the OTP to validate mobile number.

- The consumer clicks the photo of his or her identity document (National ID Card, Passport, Driver License etc.). The consumer enters the personal details or they can auto filled based on the scanning of identity document.

- The consumer takes his or her video selfie and complete the KYC process.

By adopting quick and simple customer on-boarding use journey like the one described above, the banks are trying to deliver a seamless user experience to consumers. However, while frictionless user experience is important, equally vital is security and compliance. For example, banks need to ensure that the identity documents are genuine and represents the same person who is doing the KYC process. Here comes the role of digital KYC solutions that ensure optimal security while delivering the best user experience. Let us look at some of the digital processes and technologies adopted for digital KYC.

- Optical Character Recognition (OCR): OCR scans identity documents such as National ID, driving license and passport, and converts the scanned documents into files easily read by the machines with very high accuracy. The information obtained by scanning the identity documents can be used to auto fill the KYC form to simplify and speed up the digital on-boarding process.

- Face Matching and Liveness Check: Face Matching uses Artificial Intelligence and Deep Learning algorithms to match the consumers video selfie with the photo shown in the identity document and do real-time consumer verification and authentication. Liveness Check is done to ascertain that the consumer was present himself or herself while doing the digital KYC. Hundreds of images of the consumer are taken during the video selfie and a 3D identity map is created that cannot be spoofed. Face Matching and Liveness Check accelerate the digital KYC process, while ensuring full compliance and security.

- Geo-tagging: During a video KYC, consumers geographic location (longitude and latitude coordinates) and timestamp are embedded in the video, enabling bank to confirm customers location. For geo-tagging on mobile phone, consumer has to turn on the location service and allow the banking app to access his or her location.

- ID Forgery Detection: Machine learning based algorithms to scrutinize the identity documents and images for authenticity.

- Anti-Money Laundering (AML) screening: The information shared by the consumer, such as name and date of birth, is checked against AML data and sanction list.

With branch banking on decline and accelerated pace of digital transformation, digital KYC will soon become a must have for all banks.